The 2023 State of Open Standards

This report synthesizes findings from a survey that asked LF and survey partner communities about their involvement in standards, the value of and growth in standards, and what challenges they have experienced in this practice.

The 2023 State of Open Standards Empirical Research on the Transition to Open Standards July 2023 Jory Burson, The Linux Foundation Foreword by Dr. Jochen Friedrich, IBM

The 2023 State of Open Standards Organizations prefer Over the last 3 years, 91% of organizations organizations are 12x are involved with 91% open standards 12 times more likely open standards code 7 times more than to say their value from other standards 7x open standards is increasing rather than decreasing 86% of organizations 80% of organizations 73% of organizations report there is a need state that open 80% say that open standard 73% for an open standards standards promote benefits outweigh video streaming codec competition patent royalty opportunities 72% of organizations 80% of organizations 76% of organizations say their customers say that increased say that increased prefer products and 72% use of open standards use of open standards services based on will make them more will make them more open standards competitive 80% innovative #1 Improved productivity 77% of organizations 77% 64% of organizations is the #1 reason say increasing their 64% say open standards organizations are use of open standards delivered increasing increasing their use will improve their value over the past of open standards cybersecurity three years Copyright © 2023 The Linux Foundation | July 2023This report is licensed under the Creative Commons Attribution-NoDerivatives 4.0 International Public License.

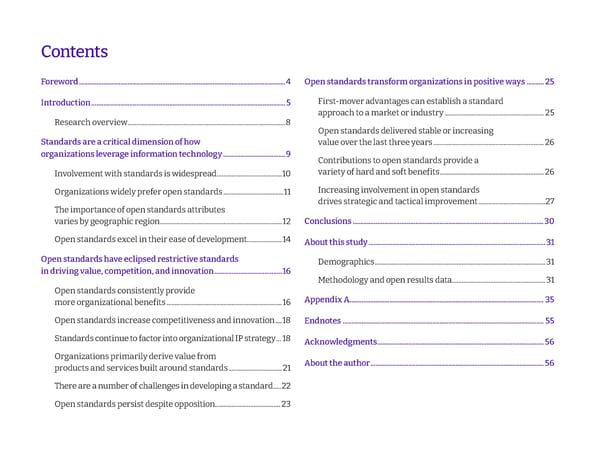

Contents Foreword .......................................................................................................................4 Open standards transform organizations in positive ways ..........25 Introduction ................................................................................................................ 5 First-mover advantages can establish a standard approach to a market or industry ........................................................... 25 Research overview ..............................................................................................8 Open standards delivered stable or increasing Standards are a critical dimension of how value over the last three years .................................................................. 26 organizations leverage information technology ....................................9 Contributions to open standards provide a Involvement with standards is widespread .......................................10 variety of hard and soft benefits .............................................................. 26 Organizations widely prefer open standards ....................................11 Increasing involvement in open standards drives strategic and tactical improvement ........................................27 The importance of open standards attributes varies by geographic region .........................................................................12 Conclusions ..............................................................................................................30 Open standards excel in their ease of development.....................14 About this study ......................................................................................................31 Open standards have eclipsed restrictive standards Demographics ......................................................................................................31 in driving value, competition, and innovation .......................................16 Methodology and open results data........................................................31 Open standards consistently provide more organizational benefits .....................................................................16 Appendix A ................................................................................................................ 35 Open standards increase competitiveness and innovation ....18 Endnotes .................................................................................................................... 55 Standards continue to factor into organizational IP strategy ...18 Acknowledgments ................................................................................................ 56 Organizations primarily derive value from About the author .................................................................................................... 56 products and services built around standards ................................21 There are a number of challenges in developing a standard .....22 Open standards persist despite opposition .......................................23

Foreword The world is doomed to innovate. We are in the middle of a major Open source and open standards together shape the open transformation where success no longer lies in simply deliv- technologies ecosystem in which collaborative technology devel- ering first-class products and first-class services. What is being opment and innovation flourish. While it is important to note that demanded and what is urgently needed is delivering first-class open source and open standards are different things, they are products and first-class services in a sustainable way. We are well intertwined in many ways. Open source software needs to imple- aware of the challenges societies and economies are facing. We are ment standards; open source is the preferred way for reference well aware of the urgency to combat climate change. Sustainability implementations that support the promulgation of standards is increasingly becoming the key differentiator and the driving and provide rapid feedback loops on functional improvements or force for innovation. identifying gaps; APIs, protocols, etc. are increasingly developed It is interesting to observe how innovation has become a common in open source and no longer in the traditional, descriptive way of objective. For sure, innovation is the basis for competitive advan- standardisation; and more. And one point is clear: in this context, tage in the market. Businesses take investments into R&D, strive only open standards really work well. for inventions and bring forward innovations for being a first Against this background, this report—The 2023 State of Open mover and for market success. Yet, innovation is increasingly not Standards—that the Linux Foundation Research prepared something that can solely be done in-house. Innovation in the IT provides highly valuable insights into needs and expectations world is increasingly done in open, collaborative ecosystems with regarding standardisation. It illustrates that the role of open stan- all players—industry, public, academia, etc.—working together. dards in IT for addressing the challenges of our time can hardly Open source software development has been the major driver of be overestimated. The report, as it were, sets a new standard for innovation in the IT sector. And competitive differentiation takes analysis and investigation of the impact of standardisation for the place on top of those collaborative innovations. global marketplace. It will appeal to business and technology strat- In addition, innovation as a common objective has become a egists, academics and policymakers in the same way, supporting focus topic for governments around the globe. Innovation and informed decision-making as well as new thinking when it comes openness are critical for tackling the challenges societies and to what is needed most: driving innovation for business success economies are facing. Governments review their policies and regu- and for the common good. Congratulations on this great work—I latory approaches with this perspective. They define respective wish everyone an enjoyable read. strategies and implement legal frameworks, aiming at promoting Dr Jochen Friedrich, IBM innovation and accelerating the digital and green transformation. And they increasingly recognise the value and benefit of open source and open standards development. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 4

Introduction Standards are “recipes for reality” that shape our physical, social, specifications based on the legal structure under which they were 1 political, and technical worlds and are largely invisible to those created. Instead, it investigates how the characteristics of the most impacted by them from day to day. Effective standards standard influence decision-making and perceived value. In partic- become so ingrained in systems that it seems inconceivable to ular, this study focuses on the spectrum of characteristics relating adopt anything different. This power to define systems and direct to open standards, where, again, no single definition of “open 5 decision-making makes it all the more important to study how standard” exists. As Sutor suggests, the “openness” of a standard organizations develop and adopt technical standards. Implicit and should be viewed as a scale rather than a binary condition, explicit decisions made during standardization have enormous reflecting qualities related to how the standard is created, how it is implications for high-level issues, such as public policy, security, maintained, what costs are involved, restrictions on the implemen- privacy, and access to global markets, and strategic issues, such as tation of the standard, and compliance requirements. Similarly, 6 product development and interoperability, quality assurance, and Krechmer identified 10 key factors for developing open standards workforce training. and recommended that SDOs maintain and publish a listing of how they address each factor. The nature of the technical needs, Indeed, there is much at stake when developing standards. That’s business requirements of those participating in its development, why Linux Foundation Research, in partnership with the Joint and other factors influence where the standard might land on a Development Foundation (JDF), Green Software Foundation, spectrum of openness. Across SDOs, one can observe a variety of OpenUK, Ecma International, OpenChain, SPDX, Trust Over IP, approaches that combine open and closed characteristics—there C2PA, GraphQL, and RISC-V International2, launched this study to can be as many approaches to standards as there are organiza- understand the state of the practice of standardization in infor- tions that develop them. Standards may be developed to support mation and computing technology in 2023. The research aims to a single company’s proprietary ecosystem. Other standards are provide insights into how organizations interpret the strategic built on a need for trust and use transparency and public access value of developing and adopting open standards as part of their to support their advancement. There are also many approaches technical roadmaps and to understand where these organizations that leverage both open and closed characteristics to exem- encounter challenges and opportunities working with or collabo- plify the needs of the ecosystem developing a standard. Many rating on technical standards. organizations developing open standards may need to restrict 3 participation by limiting contributions to members who are willing There are many definitions of standards and no uniform “standard for standards development.”4 to make a royalty-free (RF) intellectual property (IP) commitment. Common characteristics that distinguish an SDO along a spectrum Organizations may develop standards independently through of openness are shown in x and include the following: multi-party agreements, industry consortia, trade associations, • Intent: What is the business intent of the standard? or formal standards development organizations (SDOs). The variety of standards development models leads to a spectrum • Access: Who will get access to the standard? of approaches. This study does not examine standards and THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 5

• IP: What are the copyright and patent terms for contributors claims necessary for implementation (“Necessary Claims”) on and implementers of the standard? reasonable and non-discriminatory (RAND) terms that imply that • Participation: Who can participate in the development of anyone can participate in, obtain a free copy of, and implement the standard and how? the standard without a need to pay royalties or other fees. Traditional definitions of open standards generally emphasize The characteristics of open standards we’ve outlined above that the resulting documents were developed using collabora- are also shared by open source software communities, which tive, non-dominant, balanced, and consensus-based processes have grown exponentially and have influenced perspectives on that expose changes to open review and comment by anyone openness in standards development. A few decades ago, it was willing to participate. Common definitions focus on factors such as unheard of for a company to allow others access to its IP port- openness to all, transparency of the process, and access to patent folio. Today, sharing software is a common activity that allows new TABLE 1 THE SPECTRUM OF STANDARDS DEVELOPMENT Approaches vary along a continuum of characteristics Open standards Closed standards INTENT Support X company’s commercial Exchange access to IP for something Support a frictionless, open, global ecosystem ecosystem of value ACCESS Anyone who agrees to X’s Accessible by any org who agrees to Freely, publicly accessible to anyone commercial terms membership terms (maybe even a fee) IP Must agree to X’s IP licensing terms Members make IP available to Participants make IP available to all implementers, implementers under RAND terms under RAND-RF or open license terms PARTICIPATION Partner feedback programs Members only Anyone THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 6

commercial ecosystems to flourish in the face of equally fierce standards characteristics. We explored whether standards profes- market competition. No agreements need to be signed in order sionals feel that “open” means RF access to necessarily infringed IP. 7 to use open source software as defined by the OSI. However, to We explored where organizations derive value from standards. We produce open source software, many communities require RF explored what real and perceived benefits organizations receive access to IP. Without this reciprocal arrangement, access to the in exchange for participating and engaging in standards. Finally, open source software commons would be at risk. Therefore, many we explored the challenges to participating in standards develop- open source software communities look for standards that allow ment and to what extent organizational involvement in standards open source software implementations, and communities such is connected to open source. 8 as Open Innovation Network have formed to further protect open source communities from patent aggressors. From the The survey behind this report approached the subject of stan- perspective of most open source software communities, “An open dards in a simplistic way. This survey, while useful in evaluating standard is a standard that is freely available for adoption, imple- alignment with the open and closed endpoint in the standards mentation and updates.”9 continuum, did not examine the nature of this continuum with nuance. Although the survey results in this report are effective at The Linux Foundation is perhaps best known for its work in open highlighting the polarization that exists in open and closed stan- source and for supporting its flagship project community, the dards, it is important to recognize that they do not capture the Linux kernel. The Linux Foundation was formed out of a merger of different ways that open and closed standards are influenced by the Free Standards Group with Open Source Development Labs, a each other across the standards continuum. Linux Foundation combination of standards and open source efforts. Our 20+ years Research understands that follow-on research that provides a of contributions to standardization efforts are less well-known, more nuanced view of standards is necessary. Nevertheless, this but no less impactful. Nearly 20% of Linux Foundation projects are survey effectively communicates the seismic change that open related to standards and specifications, and those projects range standards are creating in the standards continuum. 10 in size, complexity, development style, and IP mode. They cut across industry, geography, and target market and have engaged Key findings from this survey are as follows: thousands of contributors, organizations, and end users. This • Open standards continue to offer strategic value for history has led us to develop our own, unique perspective on organizations: 76% of organizations say that open standards information and computing technology standardization based on will make them more innovative. principles of openness, developer-friendly tooling, straightforward • Open standards are preferred by 71% of organizations IP rights (IPR) policies, and flexible working modes. Conversely, we compared with restrictive standards (only 10%). also see many standards development projects that want to build • The top characteristics of an open standard shared by an open source software implementation to help facilitate faster, participants from all regions are being openly published and easier adoption of the standard. available RF for implementers. With this background, we are excited to share the first-ever State • Open standards encourage competition: 80% of of Open Standards report, which features insights from global organizations say open standards will make them more standards participants from a variety of organizations. Our competitive. research asked participants questions about the spectrum of THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 7

• Organizations report that accelerating market reliance on such as no or limited access to the standard, the confidentiality of standards is eight times more likely to happen with open discussions and feedback, or other barriers to participation, gener- standards than with standards that have implementation ally conflict with open source software development models. fees. We hope you are able to use this report to familiarize yourself These findings tell us that companies are leveraging open stan- with how open standards are perceived by many organizations dards to build more innovative products and increase their ability and to better understand the opportunities and benefits that to compete in the marketplace. A common, open, and RF collab- may arise through engagement with standardization projects. We oration approach to fostering innovation is a well-known pattern encourage you to further explore the study data and share your in the information and communication technology industry that findings with us. is expanding into other industries. We have also seen an increase in open standards where more restrictive standards develop- Research overview ment processes have failed to scale with the collaboration needed to add value, such as in the motion picture, energy, automotive, We conducted a worldwide online survey to collect insights about telecommunications, and manufacturing industries. Not coin- organizational involvement in standards, the values and benefits cidentally, these shifts toward open standards often mirror the of standards, the trends of standardization, and the barriers to adoption of open source within an industry. As new technologies developing and adopting standards. The survey was fielded in enable new digital processes, we often see open source software January 2023, and we received 496 valid responses, which are forming a bedrock of software stacks that companies build their the basis for the analysis presented in this report. The survey innovation around. In those situations, there is a strong comple- included questions in the following areas: Demographics, organi- mentary alignment between open source software and open zational involvement in standards, the value of standards, growth standards. Conversely, standards toward the closed (or restrictive) of standards, and the development of open standards. For more end of the spectrum tend to struggle in the context of open source information about this research approach and participants' demo- software. IP licensing models that frustrate the development of graphics, see the Methodology section of this report. an open source implementation coupled with other restrictions, THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 8

Standards are a critical dimension of how organizations leverage information technology Some SDOs have noted a decline in new standards development surveyed organizations report involvement with open standards). activities in recent years, as measured by the formation of new This declining participation in traditional SDOs, coupled with 11 and strong technical committees or working groups and the publication of strong growth in open source software investment new specifications. Indeed, many of our respondents reported demand for open standards, demonstrates how organizational that their organizations are not currently members of any SDO. At technology strategies have changed over time. The value of stan- the same time, interest in and demand for open standards among dardization hasn’t changed for an organization, but the organiza- FIGURE 1 shows that 91% of tion’s preferred methods of engagement with standards have. survey respondents are very high ( FIGURE 1 OPEN STANDARDS DELIVER HIGHER LEVELS OF ORGANIZATIONAL INVOLVEMENT What is your organization’s involvement with open or closed standards? (select all that apply) 91% Th� organization i� involv�d in �tandard� 74% 34% Th� organization i� a d�v�lop�r o� �tandard� 33% 26% Th� organization i� an adopt�r o� �tandard� 25% 31% Th� organization i� both a d�v�lop�r and adopt�r o� �tandard� 16% 4% Th� organization i� not involv�d �ith �tandard� 13% 6% Oth�r or Don't kno� or not �ur� 14% Op�n �tandard� Clo��d �tandard� 2023 STATE OF OPEN STANDARDS SURVEY, Q13, DERIVED DATA, DEVELOPMENT AND ADOPTION OF OPEN STANDARDS, SAMPLE SIZE = 496, VALID CASES = 496, TOTAL MENTIONS = 743. 2023 STATE OF OPEN STANDARDS SURVEY, Q14, DERIVED DATA, DEVELOPMENT AND ADOPTION OF CLOSED STANDARDS, SAMPLE SIZE = 496, VALID CASES = 496, TOTAL MENTIONS = 630. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 9

Our findings reinforce that implementing or co-developing a An organization’s ability to shape and influence the standards it standard is a key strategic decision in an organization’s product or builds on can greatly impact how well it recaptures value in its IT roadmap. Contrasting the high degree of reported involvement technology stack. Open standards are seen as far easier to partic- with lower rates of reported membership in standards organiza- ipate in than restrictive standards, with some interesting variance 12 furthers the evidence that open standards drive strategic tions reported in small and very large organizations. We explore this benefits on the basis of their characteristics. If one considers that further in our key findings below. “involvement” with standards is a proxy for the organizational investment of time and money allocation, R&D, evaluation, and Involvement with standards is widespread implementation, the importance of standards to the organization’s overall technology strategy is irrefutable. Standards are popular among organizations. FIGURE 1 shows that Of the organizations surveyed, 91% are involved with open stan- 91% of organizations are involved with open standards and 74% dards, and 74% reported involvement with restrictive standards with restrictive standards. The high levels of involvement with (those that do not meet traditional definitions and are royal- standards demonstrate that organizations recognize the benefits ty-bearing). While participation in standards remains high across of standards, such as ensuring that products and services are the board, our findings show that organizations widely prefer open compatible, interoperable, and policy-compliant. This high level standards regardless of type, region, size, role, or involvement of involvement also refutes arguments that open source has with standards. The disparity in preference indicates that organi- supplanted or replaced the benefits of standards development zations have deep experience engaging with standards and have within an organization. developed stronger preferences based on the outcome of those FIGURE 1 that open standards are more acces- We also observe in experiences. When asked why an organization should become sible to organizations: 65% of the organizations surveyed are involved with open standards, respondents emphasize security involved in developing open standards, compared with 49% of and quality improvements, further supporting the argument that the organizations involved in developing restrictive standards. these preferences are based on realized, rather than idealized, The number of organizations not involved with restrictive stan- characteristics and results. dards (13%) is three times higher than those that reported no Interestingly, the characteristics deemed necessary for an open involvement with open standards (4%). Further, the number of standard vary somewhat by geographic region and reflect regional organizations reporting involvement in both developing and differences in market development, public policy, and consumer adopting standards was twice as high for those participating in behavior. Despite this variation, the top characteristics of an open open (31%) compared with restrictive (16%) standards. This indi- standard—being openly published and available RF for imple- cates that organizations developing and adopting open standards menters—were highly identifiable characteristics, regardless of may be reaping additional benefits and generating positive exter- region. This indicates that the availability of a standard is the key nalities in the marketplace. These observations support the ease identifying factor of an open standard and that the organization’s in developing open standards and highlight the predominance of ability to access standards greatly influences decision-making. open standards engagement as part of organizational strategy. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 10

Organizations widely prefer open standards open standards (75%), compared with only 6% of small organiza- tions preferring restrictive standards. Adopting and developing There has been a noticeable increase in open standards in recent non-open standards may require capital or specialized resources, 13 Our study confirms this trend, with FIGURE 2 showing that years. access to information and support, the ability to influence, and a 71% of organizations overall prefer open standards in contrast capacity to participate, which is costly to smaller organizations with with restrictive standards, which are preferred by 10% of respon- constrained resources. The cost of adoption can also create addi- dents. We surmise that this minority preference reflects some tional barriers to the participation of smaller organizations in the percentage of respondents who are vendors with Necessary market—in addition to the cost of implementing a standard into a Claims or hold other rights they feel grant a market advantage. product or service, royalty-bearing standards come with licensing, Even though organizations of all sizes clearly prefer open stan- legal, or other fees that need to be absorbed or passed on to dards, small organizations show the strongest preference for customers. As a result, open standards are often seen as a more accessible and economical option for smaller organizations. From a FIGURE 2 PREFERENCE FOR OPEN STANDARDS PREVAILS ACROSS ORGANIZATION TYPES, GEOGRAPHIES, ORGANIZATIONAL SIZES, AND ROLES Comparing the models for standards development (open vs. closed), which model does your organization prefer? (select one) 71% 72% 68% 73% 67% 75% 69% 70% 65% 66% 65% 63% 10% 11% 12% 12% 11% 12% 11% 15% 7% 7% 6% 7% Ov�rall V�ndor�/ End u��r� US/CA Europ� A�ia-Paci�ic Small org� ��dium Larg� org� Ent�rpri�� D�v�lop�r� Adopt�r� Svc provid�r� org� Japan Org typ� R�gion Org �iz� Rol� Slightly or d��init�ly op�n �tandard� Slightly or d��init�ly clo��d �tandard� 2023 STATE OF OPEN STANDARDS SURVEY, SELECTED RESPONSES, OVERALL (TABLE A35), BY ORGANIZATION TYPE (TABLE A36), BY REGION (TABLE A37), BY COMPANY SIZE (TABLE A38), BY ROLE (TABLE A39), SAMPLE SIZE = 377 TO 421. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 11

The value of standardization hasn’t changed for an organization, but the organization’s preferred methods of engagement with standards have. competitive standpoint, open standards “level the playing field” for With the continued growth and adoption of open standards, we FIGURE 4. organizations of all sizes. This point is revisited in can expect to see even greater levels of involvement from a variety of organizations in the future. Geographically, although all regions clearly show a preference for open standards, North America (mostly represented by the U.S. The importance of open standards and Canada in our survey) stands out, with 73% of organizations indicating a preference for this model. Only 7% of organizations attributes varies by geographic region in North America show a preference for restrictive standards, Global engagement in open standards is driven by a desire for while 12% of respondents from Europe and Asia-Pacific prefer greater collaboration, interoperability, and access to innovation. that model. This finding is notable because of the political and However, there are regional differences in priorities and prefer- economic differences between the regions analyzed. Standards ences. Understanding these regional differences is an important development in North America is highly influenced by the U.S.’s part of developing effective and widely adopted open standards innovation-based tech economy and market-led regulation, that can benefit organizations and industries worldwide. compared with the state-controlled economies of the Asia-Pacific FIGURE 3, one key difference we found is the E.U.’s Japan (APJ) region and government-led regulations of the E.U. As shown in Indeed, each of these regions has distinct standardization philos- strong agreement that an open standard must be royalty free (RF) for ophies, and it is remarkable that open standards are the strong implementers—this position was held by 61% of respondents from preference despite these differences. Europe, compared with 54% of North American respondents and 43% of those from APJ. Royalty free refers to a license model where FIGURE 2 also shows that open standards are largely preferred the rights holders agree to license the patents necessary to imple- even when segregated by organization type and role. We observe ment the technology or standard without paying royalties or other that open standards were the overwhelming preference across licensing fees. Royalties and patent licenses are seen as a way for all segmentations. Clearly, open standards play an important, organizations to recoup investment costs in developing new technol- strategic role in an organization’s technology strategy, regardless ogies and are argued to provide incentives for innovation. In practice, of demographic differences—democratizing access for smaller however, this approach can reduce innovation in the market when organizations with fewer resources to spare, access to different these fees are cost-prohibitive to new entrants and viable alterna- geographic and commercial markets, and access to develop or tives to the incumbent, royalty-bearing standards are not available. adopt technology regardless of the industry or business model of Therefore, RF essential patent licensing standard options are seen as the organization. This helps encourage market competition and an important way to ensure competitive, democratic access to inno- other economic benefits, which we explore later when discussing vation, greatly reducing the risk of an organization monopolizing the how open standards increase competitiveness and innovation. market or controlling access to important market technology. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 12

FIGURE 3 CHARACTERISTICS OF OPEN STANDARDS SEGMENTED BY GEOGRAPHIC REGION Which characteristics do you believe are necessary for a standard to be an open standard? (select all that apply) segmented by organization region 65% Final �p�ci�ication op�nly publi�h�d and acc���ibl� 63% 51% 54% Royalty �r�� �or impl�m�nt�r� 61% 43% 44% 50% Fr�� �rom l�gal or t�chnical clau��� that limit it� utilization 40% 40% �anag�d ind�p�nd�ntly o� any �ingl� v�ndor 38% 20% 26% US/CA 30% Europ� Sa�� �or gov�rnm�nt� to �ndor�� 36% A�ia-Paci�ic 2023 STATE OF OPEN STANDARDS SURVEY, SELECTED RESPONSES, Q20 (TABLE A16) X Q7 (TABLE A7), SAMPLE SIZE = 425, VALID CASES = 425, TOTAL MENTIONS = 1,875. The survey results also highlight regional contrasts that reflect differ- competition laws in the U.S. emphasize a “free enterprise” philos- ences in policy and market behavior. Europe placed more emphasis ophy and consumer protections, while APJ economies, such as China (50%) on considering that an open standard should be “free from and Japan, feature more government-sanctioned market monop- legal/technical clauses that limit its utilization” than respondents olies. APJ’s greater emphasis (36%) on being “safe for government from North America (44%) and APJ (40%). This finding aligns with to endorse” and its greater level of comfort (20%) with an open Europe’s philosophical approach to competition laws, which empha- standard being managed by a single vendor bolster the argument size requirements for fairness and equitability among market that the valuable characteristics of an open standard vary regionally competitors. It may also reflect a response to the market dominance and reflect national economic policy—these numbers are 26% and of American companies in new technology sectors. By comparison, 40% for North America and 30% and 38% for Europe, respectively. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 13

Nevertheless, the requirement that an open standard should be Open standards excel in their “openly published and accessible” was shared across regions. The ease of development availability of a final specification that can be reviewed and evalu- ated without obstacles—e.g., fees to discover, access, or download In FIGURE 1, we observed that involvement in standards, partic- specifications—generates opportunities for greater collabora- ularly open standards, is widespread. One reason is that open FIGURE 4 shows that tion and innovation and an increased number of implementations standards may be easier to develop. Indeed, of the technology, encouraging new use cases, applications, and across the survey, 60% of organizations reported that partici- constructive feedback. pation in open standards development is easy, compared with 40% that consider restrictive standards easy to develop. This is a statistically significant gap, reflected across regions, organization size, and organization type. FIGURE 4 EASE OF PARTICIPATION IN THE DEVELOPMENT OF OPEN STANDARDS ACROSS ORGANIZATION TYPES, GEOGRAPHIES, AND SIZES How easy is it to participate in the development of a standard? (percentage selecting somewhat easy or very easy) 60% 63% 58% 64% 61% 61% 62% 63% 50% 53% 43% 46% 46% 40% 40% 39% 38% 37% 31% 32% Ov�rall V�ndor�/ End u��r� US/CA Europ� A�ia-Paci�ic Small org� ��dium Larg� org� Ent�rpri�� Svc provid�r� Japan org� Org typ� R�gion Org �iz� Op�n �tandard� Clo��d �tandard� 2023 STATE OF OPEN STANDARDS SURVEY, SELECTED RESPONSES, OVERALL (TABLE A52), BY ORGANIZATION TYPE (TABLES A53/A54), BY REGION (TABLES A55/A56), BY COMPANY SIZE (TABLES A57/A58), SAMPLE SIZE = 364 TO 406, N/A RESPONSES EXCLUDED FROM THE ANALYSIS. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 14

The difference is most profound for small organizations, which are FIGURE 2, preference for Comparing the findings highlighted in FIGURE 4, ease of participation, one less likely to have additional or specialized resources to participate open standards, with those of in a restrictive standard project. Indeed, there is more variability might expect the charts to illustrate similar variation. The levels across organization size than other segmentations, indicating of preference are strikingly high, while ease of participation is less that the challenges of participation in a restrictive standard are stark by comparison, indicating that the organizations accept any a strong limitation for certain organizations. Open standards are challenges to participation in standards development as a “cost perceived as leveling the playing field in a way that allows smaller of doing business” and likely do little, if anything, to impact pref- FIGURE 2 firms to collaborate and compete with larger, well-resourced firms. erence for open standards. The preference metrics in reflect additional perceived benefits to participating in open Additional observations support our earlier findings about char- standards development beyond ease of participation, which we acteristics and preferences. The difference in ease of participation explore in later key findings. between open and restrictive standards is the smallest for orga- nizations in the APJ region, reflecting that region’s comparative comfort with government-led market regulation. Enterprise orga- nizations reported the lowest levels of overall ease in participation, which may reflect factors such as the complexity of their organi- zational structure, legal and internal policy constraints, size-based market regulations, or more elaborate product and technology strategies to manage. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 15

Open standards have eclipsed restrictive standards in driving value, competition, and innovation Previous research has tackled the impact of open source and open instrumental in accelerating the adoption of new technologies, 14 15 16 standards development from an economic perspective. While promoting innovation in various sectors, and enabling businesses the findings of these studies give us the data to support economic to address market needs in a timely manner. As more organiza- arguments for openly developed technologies, our study provides tions embrace open standards, the industry will continue to reap additional insight into how organizations perceive the benefits of the benefits of increased innovation, better products and services, open standards. Respondents to our study strongly agreed that and a more competitive landscape. We examine the attitudes and open standards provide a real return on investment (ROI), drive key trends driving this change in the key findings below. innovation and marketplace competitiveness, and offer benefits such as improved quality, security, and firm reputation. Many Open standards consistently provide respondents also reported that while their organizations participate more organizational benefits in patent licensing as part of their business activities, the benefits of open standards outweigh the benefits of licensing royalties. Economic value is fostered when the marketplace has the right balance of competition to ensure a variety of available options In this study, we sought to learn more about how organizations to the consumer and a fair price, innovative products or services incorporate standards into their technical and business strategies to ensure appropriate quality or feature differentiation for the to capitalize on their benefits. We asked about benefits, reasons consumer, and responsiveness to changing needs and demands to for choosing an open standard strategy, competitive and innova- FIGURE 5 ensure efficiency to the resulting products and services. tive advantages of the two standardization models, and how the illustrates that open standards are viewed as far more effective at value derived from open standards is changing over time. driving economic value. This finding provides a strong rationale for We observed that organizations across the globe see value the overwhelming preference for open standards across organi- in standards, with the different approaches offering distinct zation sizes, types, regions, and industries. opportunities depending on the specific needs and goals of the FIGURE 5 shows that 73% of organizations believe that open stan- organization. While open standards are widely acknowledged dards better accelerate the adoption of a technology within the for their ability to drive innovation and meet customer prefer- market, compared with only 9% who reported better acceleration ences, patent royalties still hold value for certain organizations. from restrictive standards. Given the necessary characteristics Nevertheless, most organizations—even those that rely on FIGURE 3, this isn’t wholly of an open standard as identified in patents as a revenue source—prefer open standards and agree surprising—the publicly accessible nature of an open standard that their customers prefer to use products and services based on makes it better suited to drive widespread adoption because it is open standards. easier to access, distribute, and evaluate. Open standards have become a powerful driver of industry Widespread adoption of a standard is indicative that the standard value, market-wide innovation, and competition. They have been is efficient at addressing market needs and providing value to THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 16

consumers and competitive benefits to organizations. FIGURE 5 perspective. Appendix Table A28 shows that 94% of enterprise-sized also shows that open standards are better suited by a wide margin organizations believe that open standards enable market-wide across market needs. Respondents reported that open standards innovation and competition, which is notably higher than the unseg- are better equipped for enabling market-wide innovation and mented response rate (68% and 67%, respectively as shown in Table competition, creating new and innovative products and services, A27). This variation by organization size likely indicates the larger and addressing market needs in a timely manner. firms’ ability to capitalize on an open standard, leveraging their market size and position, greater resources, and other growth and Examining these responses by organization size offers an additional scale variables to take full advantage of the standard’s benefits. FIGURE 5 OPEN STANDARDS ARE VIEWED AS FAR MORE EFFECTIVE THAN RESTRICTIVE STANDARDS AT DRIVING INDUSTRY VALUE For the following activities, which type of standard (open vs. closed) better supports implementing these activities? (percentage selecting definitely or slightly) 73% Acc�l�rating th� �id��pr�ad adoption o� a �tandard �ithin th� mark�t 9% 71% G�n�ral pr���r�nc� o� th� organization 10% 69% Enabling mark�t-�id� innovation 10% 68% Enabling mark�t-�id� comp�tition 9% 63% Cr�ating n�� and innovativ� product� and ��rvic�� 13% 62% Addr���ing mark�t n��d� in a tim�ly mann�r 15% Slightly or d��init�ly op�n �tandard� Slightly or d��init�ly clo��d �tandard� 2023 STATE OF OPEN STANDARDS SURVEY, SELECTED RESPONSES Q28 (TABLE A27), Q33 (TABLE A33), Q34 (TABLE A34), SAMPLE SIZE = 421-422, N/A RESPONSES EXCLUDED FROM THE ANALYSIS. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 17

Small and medium-sized organizations also report a greater pref- The publicly accessible and RF characteristics of an open standard erence for open standards when it comes to enabling market allow multiple vendors to implement a technology, create compat- competition and innovation—again, this may indicate that the ible or interoperable solutions, build new features, improve combination of the organization’s unique position, coupled with the quality, or provide other value to consumers and end users. characteristics of open standards, drives this market value. Consumers, in turn, benefit from having these interoperable solu- tions and choices. At the same time, the market benefits from When organizations were asked what model they generally prefer positive externalities such as reducing the barrier to entry for new for standards development, Appendix Table A28 shows that 76% players in the market and keeping prices fair. The market decides of small organizations prefer open standards. This number is 70% which technologies are the most viable, and competition leads for medium-sized organizations, 66% for large organizations, and vendors to innovate more quickly. 65% for enterprise-level organizations. This strong preference for open standards reflects the ability to empower businesses, Moreover, the processes adopted to develop open standards have regardless of size, with the tools and resources to compete and shown to be a sustainable approach to technology development in innovate in the market. the long run. Many “legacy” open standards are still in active use and maintenance decades later. By contrast, non-open processes Open standards increase may exacerbate maintenance challenges as access to key informa- tion, decision criteria, justifications, and persons with first-hand competitiveness and innovation knowledge becomes more restricted over time. As previously noted, bringing technologies and solutions to the marketplace in a timely manner drives overall economic value Standards continue to factor into and creates competitive advantages for the contributing organi- organizational IP strategy zations. Timing novel solutions with market needs and demand is a complex objective for which open standards provide compelling Patent portfolios reflect the collection of novel IP developed by an strategies. And, like compound interest rates, early competitive organization and remain a significant source of value and oppor- benefits have a way of building and accelerating over time. We also tunity, particularly for organizations with the resources to manage FIGURE 11. their portfolios effectively. A patent gives its owner the legal right to explore this later in exclude others from making, using, selling, or importing an invention Reinforcing our previous findings that open standards are the for a limited time in exchange for publishing a disclosure of the preferred development method for market competition and inno- invention. The legal theory for this approach imagines that along vation benefits, we additionally find that open standards are with creation, public disclosure of the invention provides societal perceived as strongly facilitating organizational competitiveness benefits, while the rights protections afforded incentivize companies FIGURE 6 shows that a significant 76% and innovation over time. to invest in R&D by allowing them to profit through royalties, of organizations report that open standards increase competitive- licensing agreements, and other fees from their discoveries. ness in the short run, rising to 79% in the long run. Similarly, the impact of open standards on innovation is evident: 79% of orga- Standards-essential patents (SEPs) are commonly defined in the nizations report that open standards increase innovation in the IP policy, under which a standard is developed. SEPs refer to a short run, with this number increasing to 81% in the long run. patented invention that is necessary to implement a technical THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 18

FIGURE 6 THE IMPACT OF OPEN STANDARDS ON COMPETITION AND INNOVATION How do open standards impact competitive solution availability and market innovation? (select one response per row) Comp�titiv�n��� in th� �hort run 33% 43% 17% 6% 1.6% Comp�titiv�n��� in th� long run 46% 33% 15% 4% 1.4% Innovation in th� �hort run 37% 42% 15% 5% 1.8% 52% 29% 14% 4% 1.2% Innovation in th� long run Incr�a��� a lot Incr�a��� �lightly No chang� D�cr�a��� �lightly D�cr�a��� a lot 2023 STATE OF OPEN STANDARDS SURVEY, SELECTED RESPONSES Q22 (TABLE A18), Q23 (TABLE 19), SAMPLE SIZE = 442, N/A RESPONSES EXCLUDED FROM THE ANALYSIS. standard. When developing a standard, the IP policy for that devel- that 73% of organizations agree that the advantages of open stan- opment effort will commonly state how SEPs will be licensed. dards explicitly outweigh the patent royalty opportunities, compared Standards IP policies often require patent owners to offer a license FIGURE 7). Additionally, 72% of organiza- with just 8% that disagree ( to their patents that are SEPs under a RAND model to imple- tions agree that their customers prefer to use products and services menters of a standard. These RAND licenses often require a based on open standards, with only 8% disagreeing. This finding payment to the SEP owner but can also be licensed “royalty-free” supports both 1) there is a strategic value of patents to organizations, (RAND-RF). and 2) the strategic value to organizations is often not the monetary value that might be recouped through royalty opportunities. We do not test the theory of whether exclusive rights for patenting FIGURE 7, organizations generally report that inventions properly reward R&D investments in our study. However, Still, as illustrated in it is notable that despite the theoretical benefits, our survey found patent royalties derived from standards provide a good ROI (58% THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 19

agree). Interestingly, the survey also revealed a split decision on intentional about when they engage in standards and the licensing the value of restrictive standards and their patent royalties. While model for the outcome they desire in a standard. Sometimes, 39% of organizations disagree that standards without patent the market opportunity created from having an open standard royalties provide value, 42% agree with this notion. This suggests outweighs the value of any SEP opportunity. that both royalty-bearing and RAND-RF standards hold value for different organizations, depending on their market strategy Appendix Table A30 offers an interesting example of this dynamic. and previous experiences. It also suggests that organizations are The Asia-Pacific region is highly invested in patent royalties, with FIGURE 7 RAND AND RAND-RF STANDARDS BOTH FACTOR INTO ORGANIZATIONAL STRATEGIES How much do you agree or disagree with the following statements? (select one response per row) Op�n �tandard� promot� comp�tition �ithin 40% 40% 14% 5% 1% th� mark�t� �h�r� my organization comp�t�� Th� b�n��it� o� op�n �tandard� out��igh th� 37% 36% 19% 6% 2% pat�nt royalty opportuniti�� �or my organization �y organization r�li�� on op�n �tandard� 35% 38% 19% 7% 2% a� a ��lling point �or product� or ��rvic�� �y cu�tom�r� pr���r to u�� product� 34% 38% 19% 6% 2% and ��rvic�� ba��d on op�n �tandard� Pat�nt royalti�� �rom our organization’� IP adopt�d 21% 37% 19% 10% 12% into �tandard� o昀昀�r a gr�at r�turn on inv��tm�nt Without pat�nt royalti��, �tandard� 13% 29% 18% 16% 23% do not provid� valu� to my organization Strongly agr�� Som��hat agr�� N�ith�r agr�� or di�agr�� Som��hat di�agr�� Strongly di�agr�� 2023 STATE OF OPEN STANDARDS SURVEY, Q29 (TABLE A29), ORIGINAL SAMPLE SIZE = 422, N/A RESPONSES EXCLUDED FROM THE ANALYSIS. 20

53% of organizations focused on this approach, compared with Organizations primarily derive value from 38% in North America and Europe. Furthermore, 73% of organiza- products and services built around standards tions in the Asia-Pacific region report that patent royalties provide a great ROI compared with North America (52%) and Europe (42%). Organizations derive value from standards in multiple ways. As FIGURE 8, royalties are important to only 17% of organi- Despite this strong focus on patent royalties, the Asia-Pacific shown in region also recognizes the benefits of open standards. A notable zations responding to our study. Far more organizations reported 77% of organizations in this region state that the benefits of open that they derive value from standards in other ways, e.g., by standards outweigh patent royalty opportunities compared with focusing on services, usage, or integration with standards (55%); North America (71%) and Europe (67%). selling products into a market created by the standard (50%); or selling products built to the standard (46%). This clearly supports We also found that medium-sized and large organizations are the previous finding that standards are critical to an organization’s the most focused on leveraging patents and royalties, as shown overall technology and IP strategies. in Appendix Table A31. This might be because these organiza- tions have more resources to invest in patenting and may be The collection of royalties as a business activity varies across better positioned to negotiate licensing agreements, giving them a regions. Appendix Table A21 shows that organizations in the competitive edge in the market. Asia-Pacific region (21%) and North America (19%) are more likely to focus on collecting royalties, while European organiza- tions (7%) seldom engage in this practice. This regional disparity FIGURE 8 S�lling ��rvic�� around impl�m�nting, u�ing, 55% ORGANIZATIONS PRIMARILY or int�grating �ith th� �tandard DERIVE VALUE FROM S�lling product� or �olution� into 50% STANDARDS THROUGH a mark�t cr�at�d around th� �tandard S�lling product� or �olution� 48% PRODUCTS AND SERVICES built around th� �tandard How does your organization Coll�cting royalti�� �rom 17% generally derive value from t�chnology �� hav� pat�nt�d standards? (select all that apply) Oth�r (pl�a�� �p�ci�y) 4% 2023 STATE OF OPEN STANDARDS SURVEY, Q24 (TABLE A20), Don't kno� or not �ur� 7% SAMPLE SIZE = 442, VALID CASES = 442, TOTAL MENTIONS = 800. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 21

demonstrates the different market approaches and priorities that There are a number of challenges exist within the global technology landscape and supports our in developing a standard previous observation that the importance of different attributes of open standards varies by region. All standards development efforts face challenges at some point in their formation, advancement, or implementation. Challenges Regardless of the region or type of organization, organizations related to licensing, management, and control of IPR are common derive value from standards in one or more ways. In order to concerns, particularly in RAND projects. Indeed, three of the four maximize that value, organizations should carefully assess the challenges in FIGURE 9 are specifically aligned with character- benefits and limitations of standards and take proactive steps to istics of non-open standards, while the fourth challenge (resolving identify the most suitable approach for their specific needs and technical disputes) is common across all standards projects. The market objectives. necessary characteristics of open standards as identified in our FIGURE 9 RESTRICTIVE STANDARDS HAVE SIGNIFICANT BARRIERS TO ADOPTION Which of the following do you consider to be barriers to the widespread adoption of a standard? (select all that apply) Con�id�ntiality r�quir�m�nt� and limiting 58% participation in th� d�v�lopm�nt proc��� Th� tim�, compl�xity, and co�t o� 51% lic�n�ing ����ntial pat�nt� Lack o� control about th� dir�ction�, chang��, 43% and �upport in privat� d�v�lopm�nt R��olving di�put�� on 42% t�chnical �l�m�nt� Non� o� th� abov� 6% Don't kno� or not �ur� 3% 2023 STATE OF OPEN STANDARDS SURVEY, Q32 (TABLE A33), SAMPLE SIZE = 421, VALID CASES = 421, TOTAL MENTIONS = 850. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 22

previous finding—an openly published final specification and RF Finally, 43% of organizations identified the lack of control over for implementers—are well suited to mitigating the challenges our the direction, changes, and support as a significant challenge. respondents identified. This issue may arise because of the perceived challenges in One of the leading challenges to adoption, cited by 58% of organi- providing input or influence to non-open standards processes. FIGURE 9, is the confidentiality requirements that limit Additionally, information about the development process—e.g., zations in the use cases, requirements, proposed or competing alterna- participation in the development of a standard. Specifications tives, and justifications for a preferred approach—may be opaque developed outside an SDO may be subject to multi-party non-dis- or member-confidential. This is a significant barrier to adoption closure agreements. Although it is rare for participants in SDOs because it hinders the evaluation of the standard and puts later to be required to sign non-disclosure undertakings, many SDOs participants in the standard at a significant disadvantage. A prime conduct collaborative activities behind a “member wall” that example of this challenge is the Master Quality Authenticated restricts access to members and select invited participants (the (MQA) standard in the digital audio playback industry. While the reason is to prevent non-members, who are not bound by the standard promises superior sound quality, the techniques used organization’s IPR policy, from filing patent claims based on the to achieve this result are not publicly disclosed, creating issues work in process). Policies related to membership, such as whether for consumers who want to evaluate compatibility, implementa- there is a membership fee, the extent to which work items can be tion requirements, and other variables. Additionally, the high costs shared outside the member wall, and public review procedures, associated with licensing and implementing MQA may further are common and vary across SDOs. discourage adoption, even though the technology has been shown Another significant challenge, according to 51% of organizations to be effective. surveyed, is the time-consuming, complex, and costly process of obtaining, managing, and licensing essential patents. Licensing Open standards persist despite opposition an essential patent is an involved process that requires precise determination of the innovations being made available to which Despite the widespread preference for and numerous benefits licensors, for which purpose, and at what price and terms. This of open standards, non-open, royalty-bearing standards remain usually requires negotiations that can take months or years to pervasive in certain technology spaces, such as video codecs. determine and introduces cost and complexity to the standard’s This area has a notable lack of widely adopted open stan- development that many organizations cannot bear without signif- dards and in most cases has faced sharp resistance to them icant financial and organizational commitment. By comparison, by the rights holders of incumbent, royalty-bearing standards licensing essential patents is far more straightforward under to protect those revenue streams. For example, the Alliance common open standards development modes—the patent holder for Open Media (AOM)17 is a non-profit industry consortium generally retains their rights to the innovation but grants an RF that develops open standards for multimedia delivery with a license to use any essential patent required for implementers. focus on streaming use cases that alternative standards have There may be a process for the exclusion of certain patents, but largely ignored. AOM develops the AV1 video codec for trans- the process is generally simpler under common models for open mitting multimedia content over the Internet, which competes standards. with an established High Efficiency Video Coding (HEVC) RAND standard. HEVC rights holders have challenged AV1, attempting THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 23

to limit its adoption, reduce choice for consumers, and continue a lock-in for a standard that was not designed for modern streaming use cases. A silver lining to these challenges is that there is a growing demand for a free and open standard that can be universally adopted and FIGURE 10 implemented without any financial or legal barriers. shows that when asked if there is a market need for an open standard video streaming codec that is RF for implementers, 86% of organizations said “yes” and 14% said “no.” The overwhelming majority of organizations acknowledging the need for such an open standard codec suggests that many businesses and indus- tries are seeking an open standard designed for streaming use cases that may also create a more equitable playing field. This trend reflects a broader shift toward open standards and high- lights the increasing importance of accessibility, affordability, and interoperability in today’s digital landscape. FIGURE 10 THERE IS A CLEAR DEMAND FOR AN OPEN STANDARD VIDEO STREAMING CODEC Is there a market need for an open standard video streaming codec that is royalty-free for implementers? (select one) Y�� 86% No 14% 2023 STATE OF OPEN STANDARDS SURVEY, Q36 (TABLE A42), SAMPLE SIZE = 421, N/A RESPONSES EXCLUDED FROM THE ANALYSIS. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 24

Open standards transform organizations in positive ways As earlier findings in this study have supported, there are clear First-mover advantages can establish a preferences for and market benefits to RAND-RF, open standards. standard approach to a market or industry Nevertheless, some organizations continue to support royal- ty-bearing standards for the purposes of protecting proprietary Recalling the video codec industry example, RAND-RF stan- technologies or specialized solutions. The two models drive inno- dards can face stiff opposition from rights holders engaging in vation differently depending on the circumstances of the market RAND standards development. The video codec space is heavily or specific industry requirements. They also affect organizations patent-encumbered, as compression and streaming techniques engaging in standards development in vastly different ways— have high applicability across lucrative channels, such as digital an organization participating in the development of RAND stan- media production and content streaming. While this study does dards may have to spend more of its resources defending a patent not specifically focus on the video codec industry, we can observe position, whereas one developing open standards may be able to that the earliest standards for video codecs, such as H.261, were spend more of its resources on innovation activities. developed under RAND policies and more restrictive processes, which generally remain in place today. Open standards, such as Our results also show that open standards have experienced AV1, have seen limited adoption thus far as small groups of patent growing adoption across various industries due to their inherent owners vigorously defend their existing business models. benefits and characteristics. A significant number of organiza- tions in our survey reported an increase in value provided by open The extent to which the dominant approach to standardization for standards over the last three years, while only a few experienced the video codec industry has stifled innovation may be argued. a decrease. We also observed a positive correlation between the Our survey asked which approach organizations believe provides increased adoption of open standards and increased benefits such the most innovation value in the video codec space, given that FIGURE 11, the as enhanced competitiveness, innovation, and security. These market’s particular conditions. As illustrated in findings also support the earlier observation that open stan- results show a clear preference for open standards, with 67% dards provide a generally faster approach for bringing innovations of organizations believing that open standards are the best way to market, potentially creating competitive advantages as early to drive innovation in the standards, such as video streaming market successes compound value over time. codecs. Only 14% of organizations side with RAND standards as the primary driver of innovation. This result is highly correlated In addition to market benefits, organizations can gain strategic, FIGURE 10, with the 14% of respondents who answered "No" in tactical, and indirect advantages by actively participating in devel- indicating that a minority still prefer RAND approaches for driving oping and implementing open standards. Some of the advantages innovation. reported include improved productivity, reduced total cost of ownership, avoidance of vendor lock-in, and increased attractive- Interestingly, 19% of respondents who agreed that there is a FIGURE 10 ness as a workplace. Survey respondents overwhelmingly agreed marketplace demand for an RF, open video codec in FIGURE 11 that open and restrictive approaches that their organizations should increase participation in open stan- responded in dards for these reasons. provide the same amount of innovation value to the video codec THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 25

Open standards delivered stable or FIGURE 11 increasing value over the last three years INNOVATION THROUGH STANDARDS SUCH AS Open standards have been gaining traction across various indus- VIDEO STREAMING CODECS IS BEST ACHIEVED tries as a development and innovation methodology. THROUGH OPEN STANDARDS We hypothesize that this is because the necessary characteristics of open standards—public availability of the final specification For standards such as video streaming codecs, and RF for implementers—have consistently delivered competitive which approach will provide the most innovative benefits, greater innovation, cost savings, and other advantages value to the industry? (select one) over time. Our findings greatly support this idea, and FIGURE 12 shows that 64% of organizations in our survey reported that the value provided by open standards to their organizations has Op�n 67% increased over the last three years. In contrast, only 5% of organi- �tandard� zations indicate that the value derived from open standards has decreased, and 32% believe that the value remains unchanged. Th� 19% These findings offer a powerful testimony to the multidimen- �am� sional value proposition of open standards and the significance of open standards in today’s rapidly evolving technological land- Clo��d 14% scape. An overwhelming 95% of organizations state that the �tandard� value derived from open standards either remains constant (32%) or is increasing (64%), with only a small percentage reporting a 2023 STATE OF OPEN STANDARDS SURVEY, Q35 (TABLE A40), SAMPLE SIZE = 421, N/A decrease in value. We can expect to see greater adoption and RESPONSES EXCLUDED FROM THE ANALYSIS. development of open standards in the near future. Contributions to open standards provide industry. This highlights the finding that these approaches drive a variety of hard and soft benefits innovation differently, depending on the specific circumstances and requirements of the industry. While, as our study finds, open Contributing to open standards development brings a plethora FIGURE 13 standards are preferred and provide more overall benefits, RAND of benefits to address business and customer needs. standards can offer unique benefits in certain situations, such as shows that 84% of respondents agree that their organization when protecting proprietary technologies or focusing on special- should contribute to an open standard to improve its overall ized solutions that require significant investment and dedicated quality, and 79% feel the same way about security. This reflects expertise. In some cases, a combination of RF and royalty-bearing the widespread acceptance of “Linus’s Law” as a development standards might be necessary to strike a balance between encour- approach—because open standards are available for everyone aging widespread collaboration and protecting critical IP. to review, implement, and thus find areas of improvement and THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 26

benefits can make the organization a better place to work, helping to attract better talent, which indirectly drives up customer value FIGURE 12 and overall satisfaction. OPEN STANDARDS VALUE TO ORGANIZATIONS OVER THE LAST THREE YEARS IS ACCELERATING Increasing involvement in open standards Over the last 3 years, how has the value that your organization drives strategic and tactical improvement derives from open standards changed? (select one) Open standards have become increasingly important in the global business landscape, offering numerous advantages to organi- It ha� incr�a��d FIGURE 14 a lot 19% zations, as we have identified throughout this study. suggests a positive cause-and-effect relationship between the increased adoption of open standards and improvements in areas It ha� incr�a��d 45% where open standards have proven valuable, such as compet- itiveness, innovation, and security. Actively participating in the It ha� �tay�d 32% development and adoption of open standards can help organiza- th� �am� tions stay ahead by fostering a culture of innovation and market- It ha� d�cr�a��d 4% place competitiveness and ensuring the robustness and security of their products and services. It ha� d�cr�a��d 1% FIGURE 14 reveals several tactical a lot In addition to strategic benefits, and indirect advantages associated with the increased adoption of open standards, such as improved productivity, reduced total cost 2023 STATE OF OPEN STANDARDS SURVEY, Q41 (TABLE A48), ORIGINAL SAMPLE SIZE = 410, of ownership, less vendor lock-in, and a more attractive workplace. N/A RESPONSES EXCLUDED FROM THE ANALYSIS. By adopting open standards, organizations can streamline their operations, minimize costs, promote flexibility, and attract top talent in the industry. provide feedback, key problems are more quickly identified and resolved. Standards development organizations that charge for their standards may gain less benefit from this “law” to the extent that fewer people review them. Other benefits our respondents report include improving the organizational reputation through active contribution and partic- ipation (79%), increasing the desirability of the organization’s culture (75%), and fulfilling an implicit moral obligation that comes with benefiting from the use of open standards (74%). These “soft” THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 27

FIGURE 13 WHY ORGANIZATIONS SHOULD CONTRIBUTE TO OPEN STANDARDS Why should your organization contribute to open standards development? (select one response per row) 42% 37% 16% 4% 1% Improv� ��curity Improv� th� ov�rall quality o� th� 40% 44% 12% 3% 1% op�n �tandard� that th�y ar� curr�ntly u�ing Improv� th� r�putation o� th� organization 36% 43% 17% 3% 1% 33% 42% 20% 4% 1% B� a mor� a琀琀ractiv� plac� to �ork 29% 45% 19% 5%2% Ful�ill it� moral obligation Strongly agr�� Som��hat agr�� N�ith�r agr�� or di�agr�� Som��hat di�agr�� Strongly di�agr�� 2023 STATE OF OPEN STANDARDS SURVEY, Q45 (TABLE A59), SAMPLE SIZE=496, N/A RESPONSES EXCLUDED FROM THE ANALYSIS. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 28

FIGURE 14 BENEFITS FROM INCREASED ADOPTION OF OPEN STANDARDS My organization should increase its adoption of open standards to: (select one response per row) 45% 38% 14% 3% 1% Improv� productivity Improv� ��curity 44% 34% 16% 6% 1% B�com� mor� innovativ� 41% 35% 19% 3% 1% 41% 35% 18% 5% 1% Avoid v�ndor lock-in 41% 16% 4% 1% B�com� mor� comp�titiv� 39% 40% 38% 16% 5% 1% Lo��r co�t o� o�n�r�hip 39% 38% 18% 4% 2% B� a mor� a琀琀ractiv� plac� to �ork Strongly agr�� Som��hat agr�� N�ith�r agr�� or di�agr�� Som��hat di�agr�� Strongly di�agr�� 2023 STATE OF OPEN STANDARDS SURVEY, Q39 (TABLE A46), SAMPLE SIZE = 410, N/A RESPONSES EXCLUDED FROM THE ANALYSIS. THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 29

Conclusions Open standards are an ideal approach for the widest diffusion remain prevalent where an extraordinary commitment and invest- and adoption of a technology. The overwhelming support for ment in technology is needed to make a meaningful advance and open standards indicates that we have passed the inflection in older industries where proprietary technologies have domi- point where the utility of open standards is greater than more nated or limited competition (e.g., due to the cost or complexity restrictive approaches to standards. This survey reviewed a wide of entering a market). Quantum computing is such an example. variety of attitudes about standards. Results consistently show While many patents have been filed for quantum computing, that involvement in, preference for, and adoption of open stan- 18 the University of Waterloo’s open projects, such as IBM’s Qiskit, 19 20 dards are widely greater than restrictive standards. The benefits libOQS for quantum-safe computing, and Quil, a programming delivered by open standards were also reported to extend beyond language for quantum computations, are emerging to encourage the organization’s boundaries, accelerating competition and inno- greater compatibility and alignment across the field. As markets vation within markets and industries. Open standards are driving grow, technologies commoditize, and costs decrease, open tech- more benefits in innovation and competitiveness (particularly for nologies will proliferate within a given industry and eventually small organizations) and more value to organizations over time displace royalty-bearing standards as the dominant approach. and delivering more positive transformational benefits for contrib- uting. These factors, combined with the necessary characteristics Organizations are drawn to open standards as the solution of of open standards, accelerate innovation and spread standards choice for their strategic needs. Developers and adopters of across industries further and more quickly. standards clearly prefer open standards. Our results show that organizations highly value several benefits of open standards: Key findings that have emerged as a result of this research include Enabling market-wide innovation and competition, supporting that 80% of organizations say that open standards make them new and innovative products and services, addressing market more competitive, 76% say that increased use of open standards needs in a timely way, meeting customer preferences, lowering the is making them more innovative, and 71% prefer open standards. total cost of ownership, and facilitating participation. Additionally, These findings tell us that organizations have determined that organizations believe that these benefits outweigh patent royalty open standards are a more efficient path to being more innovative opportunities and, in many cases, rely on open standards as a and competitive. If the trends identified in this survey persist, it selling point for products and services. Over the past three years, may be that other approaches to standards-making will be increas- the value derived from open standards has increased in organi- ingly relegated to specialized use cases. zations 13 times more than it has decreased. As organizations incorporate open standards further into their technology strategy, Our research shows continued organizational participation there can be no doubt that the value of open standards will in royalty-bearing standards activities, despite overwhelming continue to grow, providing a greater ROI. support and preference for RF open standards. RAND standards THE 2023 STATE OF OPEN STANDARDS EMPIRICAL RESEARCH ON THE TRANSITION TO OPEN STANDARDS 30